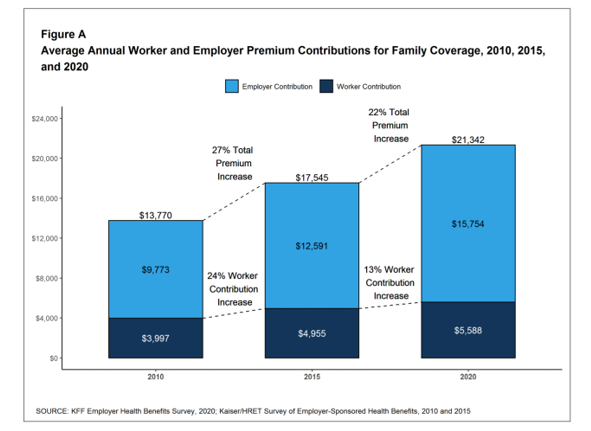

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $ 21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation.

The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $ 13,770 in 2010 to $ 21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020.

The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $ 13,770 in 2010 to $ 21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020.

Single coverage reached $ 7,470 in 2020 and was $ 5,049 in 2010.

Roughly the same proportion of companies offered health benefits to at least some workers between 2019 and 2020, about 56% of firms.

Nearly one-half of covered workers enrolled in a PPO, the most popular plan type in 2020. 31% of workers enrolled in a high-deductible health plan with a savings option, 13% in an HMO, and 8% in a point-of-service plan (POS, a hybrid of an HMO and PPO).

Most workers faced a deductible in their health plan.

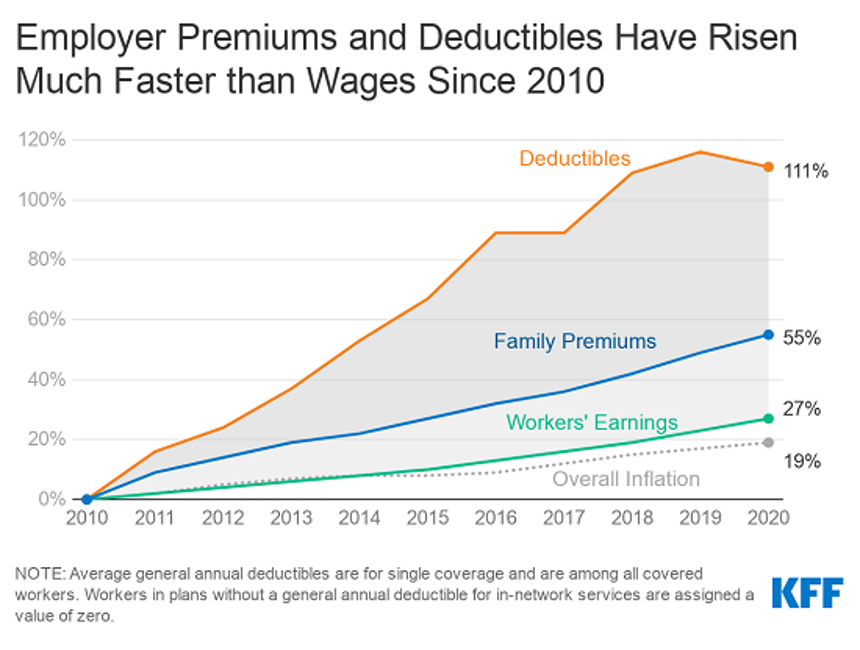

Workers’ earnings grew by 3.4 in 2020, as family premiums increased by 4.0% and inflation, 2.1%. This premium growth was 1 percentage point below the 5% uptick in 2019. For context, since 2012, the annual cost increase for family premiums ranged between 3% and 5%, so the 2020 rate of 4% fell within a fairly normal range of 3-5% seen over the past eight years.

Even with that moderate increase, this post’s title reports the study headline that workers’ health insurance premiums continue to grow faster than wages: cumulatively since 2010, family premiums grew by 55% and deductibles, 11%. Workers’ earnings increased 27% in the period and inflation, 19%.

Workers receiving health insurance through their jobs have seen their portfolio of benefits changing over the years. In 2020, KFF found that 89% of large companies offered a telemedicine benefit, compared with 82% in 2019 and 74% in 2018. 81% of large firms offered a wellness or health promotion program, including health risk assessments, biometric screening or both.

Workers receiving health insurance through their jobs have seen their portfolio of benefits changing over the years. In 2020, KFF found that 89% of large companies offered a telemedicine benefit, compared with 82% in 2019 and 74% in 2018. 81% of large firms offered a wellness or health promotion program, including health risk assessments, biometric screening or both.

Three in four large companies also offer health benefits that cover retail clinics’ care, including sites in pharmacies, grocery stores and retailers.

Among large firms offering wellness or health screenings, 56% say the programs have improved health and wellbeing, 39% believe the programs have effectively reduced healthcare utilization, 38% say they reduced the firm’s costs, and 28% believe the programs reduced absenteeism.

A newer survey question in the study assessed firms charging penalties to employees who not only use tobacco, but vape: the largest firms employing 5,000 or more workers more likely than small cos. penalize employees who smoke or vape via higher premiums or cost-sharing (32%) or charging direct payments or payroll deductions (18%).

The study was conducted among 1,765 non-federal public and private firms with at least three employees between January and July 2020; KFF notes that one-half of the interviews were conducted, “before the full extent of the coronavirus pandemic had been felt by employers.”

Health Populi’s Hot Points: In the report’s discussion, KFF recognizes that this year’s study, the 22nd annual, was fielded in the unprecedented time of the coronavirus pandemic. This will inevitably change the results of what we will see one year from now in 2022.

Job losses in the public health crisis have resulted in millions of American workers and families losing health benefits. KFF wonders about the continued availability of coverage for furloughed workers, laid-off workers electing COBRA health insurance continuation, and changes that could be made to employee benefit programs for mental and financial wellness — two toxic side effects of the COVID-19 pandemic.

Job losses in the public health crisis have resulted in millions of American workers and families losing health benefits. KFF wonders about the continued availability of coverage for furloughed workers, laid-off workers electing COBRA health insurance continuation, and changes that could be made to employee benefit programs for mental and financial wellness — two toxic side effects of the COVID-19 pandemic.

“Spending in 2021 remains uncertain as employers and insurers continue to adapt to an evolving situation. We do not know how the reduced use of care earlier this year will affect future costs and premiums,” KFF humbly concludes at the end of the 2020 report.

Amidst these uncertainties, the one certainty is that employers’ decisions about how to design health plans in 2021 will unfold over time — and that return-to-work in any “normal” way cannot be predicted in terms of timing or the shape of health benefits offered one year from now. The other certainty will be workers’ collective need to address their anxiety and stress, and financial health of their households in the wake of the recession that may last into 2022.

FYI, I’ve covered the KFF Survey annually here in Health Populi. Here are the past four years’ links for historical context and your reading pleasure…

2019 – “It’s the Deductible, Stupid” – Health Premiums Reach $ 20,576 for a Family

2017 – Employees Continue to Pick Up More Health Insurance Costs, Even As Their Growth Slows

2016 – Employer Health Insurance Costs Reach $ 18,142

Back-posts can be fou

nd by typing “KFF employer health” in the search box at the top of the blog.