Our feet have become an important health focus during the pandemic, as the importance of exercise-as-medicine and mental health helper has looked to walking, running, and biking as good-for-us physical activities.

Our feet have become an important health focus during the pandemic, as the importance of exercise-as-medicine and mental health helper has looked to walking, running, and biking as good-for-us physical activities.

The Mayo Clinic published an informative piece on Feet and the COVID-19 Pandemic, and the Cleveland Clinic posted advice on exercising during the pandemic earlier this month with the strong recommendation of walking.

So it makes sense that the apparel category whose brand equity grew most between 2020 and 2021 was footwear, announced in the Brand Finance Apparel 50.

So it makes sense that the apparel category whose brand equity grew most between 2020 and 2021 was footwear, announced in the Brand Finance Apparel 50.

Each year, Brand Finance evaluates the value of “brands,” as defined as that intangible asset encompassing names, signs, symbols, logos, designs, and associations made int he minds of stakeholders that, together, generate economic benefits.

In the COVID-19 pandemic era of retail and consumers, it’s useful to consider Brand Finance’s findings in terms of where people found value in the face of the public health crisis.

In terms of apparel, that value grew faster for footwear than for any other apparel category. In fact, value for all other categories fell between 2020 and 2021, especially hard-hit for underwear (!), high street designers, and luxury goods.

In the pandemic, we’ve been living through #StayHome, #WorkFromHome, and #SchoolFromHome life changes. Those people who have undergone digital transformations in daily living are experiencing so much of life on screens, for work dressing “above the waist. The apparel industry was hard-hit, shifting to ecommerce from brick-and-mortar retail shopping.

We changed our clothes in the pandemic, as the NPD Group re-assessed the Wear-to-Work trends in apparel re-shaped by the coronavirus era.

The footwear category was profoundly changed by the pandemic in terms of consumers’ search for health and wellness, fitness from home, and comfort-casual and the athleisure fusion of fashion and athletics.

Walking, running, going outside for fresh air required shoes and for many people, new shoes.

Two luxury goods brands took 2nd and 3rd place — Gucci and Louis Vuitton — followed by Adidas in #4, another footwear brand.

In its analysis of the COVID-19 fallout at shoe retailers, the NPD Group pointed out that with gyms and fitness centers closed, the home became the hub for fitness and workouts, and performance running shoe sales grew during the COVID-19 recession. “The virus itself has motivated many consumers to adopt healthier practices and place a greater emphasis on their physical health and wellbeing,” the analysts believe.

Health Populi’s Hot Points: Please indulge me in this retail/brand analysis, as I’m the daughter of a father who was in the clothing industry; I come by my interest in retail, marketing and apparel via DNA. I was very close with both my Dad and his brother Alvin Sarasohn, who was one of the original Mad Men in American advertising, another reason you see me covering marketing and media in my approach to HealthConsuming™.

Health Populi’s Hot Points: Please indulge me in this retail/brand analysis, as I’m the daughter of a father who was in the clothing industry; I come by my interest in retail, marketing and apparel via DNA. I was very close with both my Dad and his brother Alvin Sarasohn, who was one of the original Mad Men in American advertising, another reason you see me covering marketing and media in my approach to HealthConsuming™.

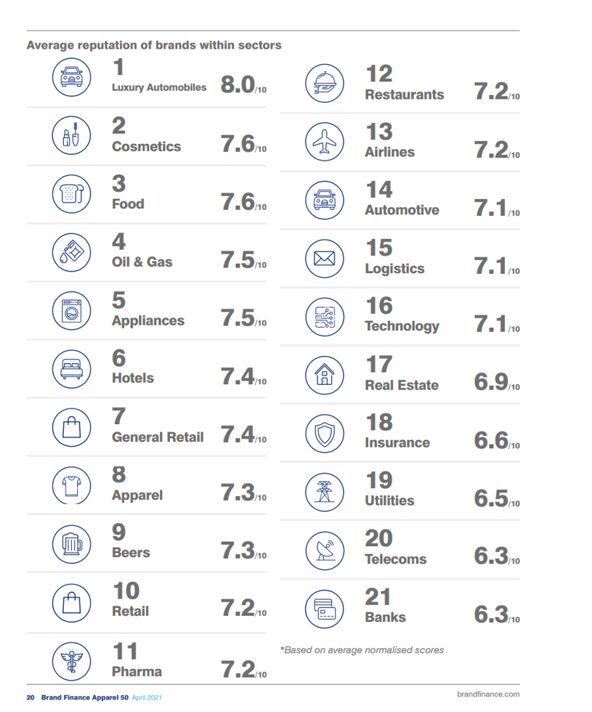

As for brands in health care, while we might pay for medical services and products as if they are priced as luxury goods (the apparel segment ranked first in overall brand reputation), pharma as a branded industry ranked 11th on the list of 21 industries in Brand Finance 2021’s study across sectors. (Note that two pharma brands were among the fastest growing consumer brands in 2020: Pfizer and AstraZeneca, discussed here in Health Populi.

Cosmetics and food ranked 2nd and 3rd, tied, closely followed by many other industries.

Looking at the fine print of the index numbers, Pharma really isn’t that far behind other industries in this study, falling just under apparel and beers, and tied with retail, restaurants, and airlines.

Telecoms and banks ranked last on the list by brand reputation.

The pandemic has undoubtedly and profoundly re-shaped people as consumers, patients, and health citizens. What we have learned dealing with the crisis in our homes, communities, workplaces and schools is blurring into our relationship with our own health, well-being, and healthcare system decisions and interactions.

We’ve seen shifts toward cooking for health at home, increasing use of vitamins and supplements to bolster immunity, growing use of wearable tech for fitness and medical care, and other more radical acts of self-care in the wake of the pandemic. These choices will persist for many as the pandemic becomes endemic and longer-lived than anyone of us would have predicted in March 2020 as the virus took on the persona of “pandemic.”