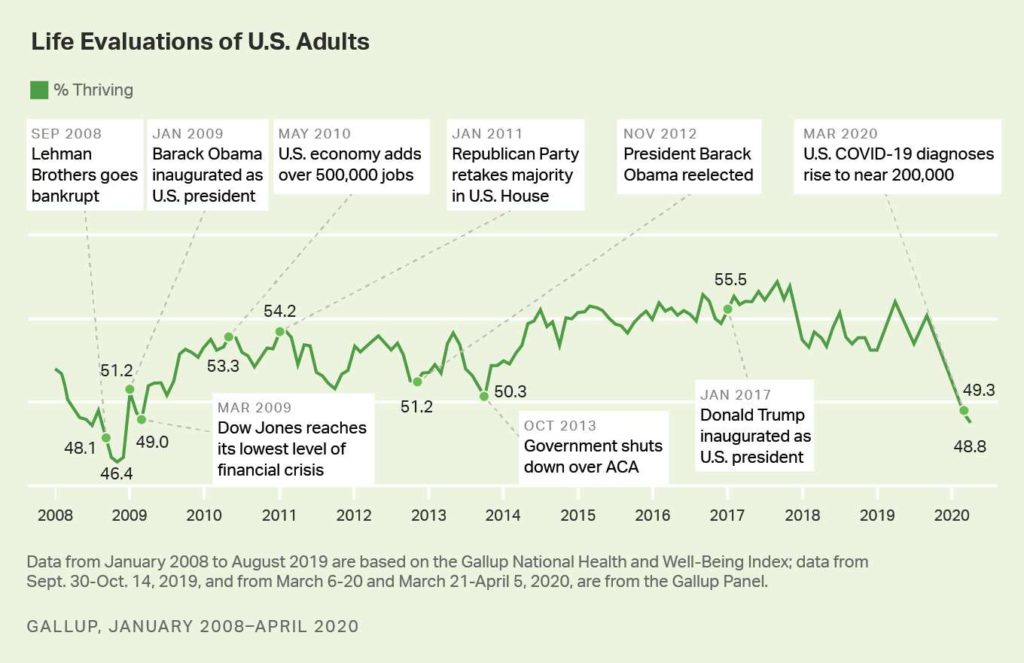

It’s déjà vu all over again for Americans’ well-being: we haven’t felt this low since the advent of the Great Recession that hit our well-well-being hard in December 2008.

As COVID-19 diagnoses reached 200,000 in the U.S. in April 2020, Gallup gauged that barely 1 in 2 people felt they were thriving. In the past 12 years, the percent of Americans feeling they were thriving hit a peak in 2018, as the life evaluations line graph illustrates.

Gallup polled over 20,000 U.S. adults in late March into early April 2020 to explore Americans’ self-evaluations of their well-being. FYI, Gallup asks consumers to score themselves as “thriving,” “struggling,” or “suffering” on a scale of 0 to 10 (for further details, see the Cantril Self-Anchoring Striving Scale).

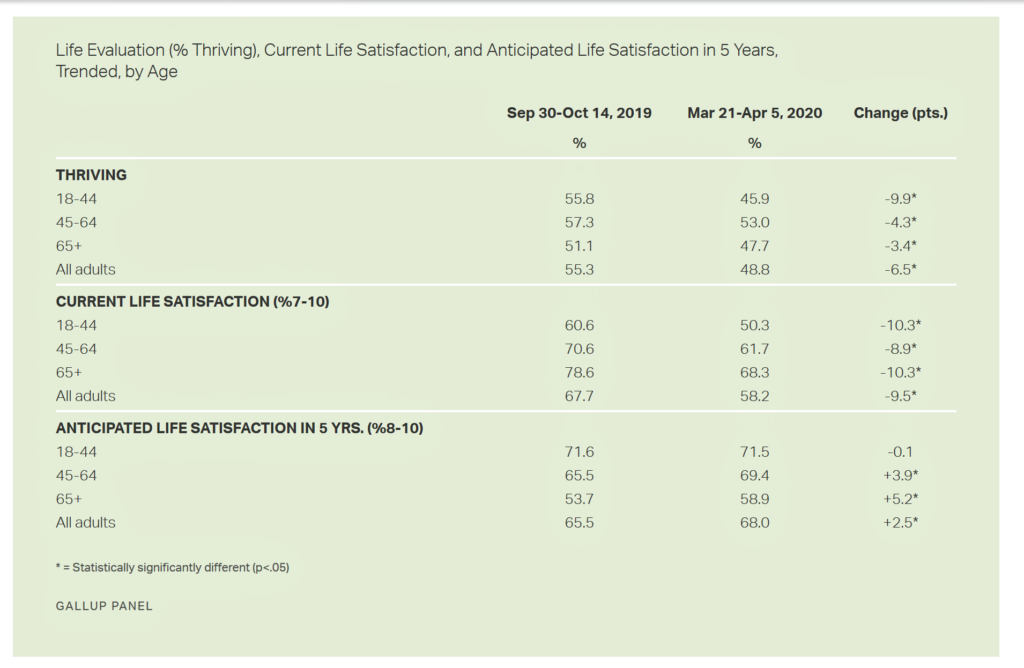

Peoples’ sense of life satisfaction varies by demographics. Overall, the percent of people who said they are thriving fell by 6.5 percentage points. But younger peoples’ sense of thriving dropped the most in the past six months: for people 18-44, the percent thriving fell by nearly 10 percentage points, the second table shows.

Look at how people are feeling about the future in terms of anticipated life satisfaction in five years, shown the bottom segment of this table. Among all U.S. adults, 65.5% anticipate they’ll be thriving in 5 years, an increase of 2.5 percentage points over six months ago.

In terms of current life satisfaction, 58% see their lives as thriving. The current proportion of younger people 18-44 as thriving is only 50%, a far lower proportion than people 45 and over.

Gallup notes, “Historically, the likelihood of thriving in life evaluation is highest among those aged 18-44 and erodes with age after that point.”

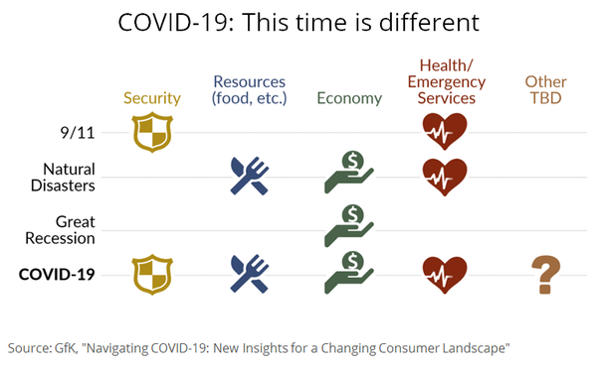

Health Populi’s Hot Points: To further inform insights from the Gallup poll, I looked at a study From GfK on Navigating COVID-19, exploring changing consumers. GfK looked at consumers across four significant stressful events: 9-11, natural disasters, the Great Recession, and COVID-19.

Health Populi’s Hot Points: To further inform insights from the Gallup poll, I looked at a study From GfK on Navigating COVID-19, exploring changing consumers. GfK looked at consumers across four significant stressful events: 9-11, natural disasters, the Great Recession, and COVID-19.

“This time is different,” GfK observes, arraying impacts of security, resources, the economy, health, and other items yet to be seen.

Why is this time different from these other events?

My take as I develop scenarios in my advisory work for the next 1:3:5 years is that in the exogenous shock of COVID-19, Americans are doubly-hit, quite directly, with both the physical/health pandemic concerns coupled with financial worries.

The Great Recession was a direct hit on national and personal economics; health was an indirect impact. No question that health care and peoples’ individual health status were impacted by the 2008-2010 economic decline, but these were not the headline story.

The Great Recession was a direct hit on national and personal economics; health was an indirect impact. No question that health care and peoples’ individual health status were impacted by the 2008-2010 economic decline, but these were not the headline story.

The double-whammy of the coronavirus pandemic with growing unemployment and income hits to millions of Americans combine financial stress with physical and emotional stress. This is happening within the U.S., and globally.

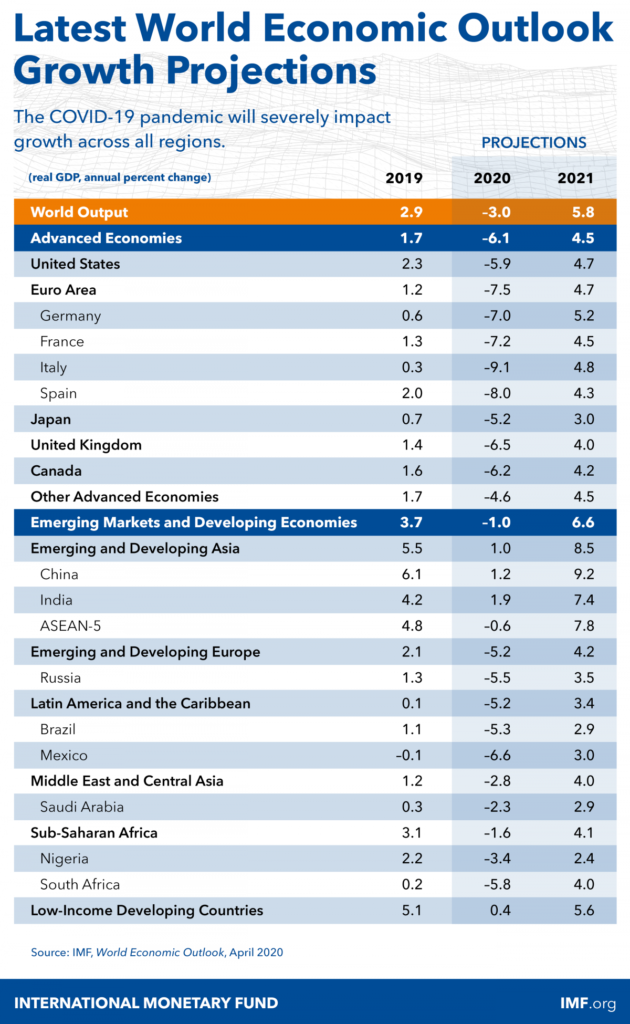

Today kicked off the annual 3-day meeting of the World Bank and International Monetary Fund in Washington, DC. This meeting is usually a huge in-person session with bankers assembling from around the world in our nation’s capital, to share nations’ and global perspectives of the financial markets, risks, and development prospects. Earlier today, the IMF published its outlook on the global economy.

In her blog on this first day of the World Bank/IMF conference, Gita Gopinath wrote about The Great Lockdown: Worst Economic Downturn Since the Great Depression.

Read carefully. That’s “Depression,” not “Recession.”

Gita included the last bar chart in her essay, clearly showing that in the Great Lockdown era of 2020 (now), real GDP globally will shrink 3.0%. In the depths of the Great Recession in 2009, the globally economy declined by 0.1%, staying relatively flat.

“For the first time since the Great Depression both advanced economies and emerging market and developing economies are in recession,” Gina writes. In 2020 advanced economies (including and beyond the U.S.) will decline by -6.1%. Emerging and developing markets’ decline is estimated at -1.0%.

In 2021, all economies are expected to recover at some level, the brighter news in the third column in the last chart.

“Flattening the spread of COVID-19 using lockdowns allows health systems to cope with the disease, which then permits a resumption of economic activity. In this sense, there is no trade-off between saving lives and saving livelihoods,” Gita writes. “Countries should continue to spend generously on their health systems, perform widespread testing, and refrain from trade restrictions on medical supplies. A global effort must ensure that when therapies and vaccines are developed both rich and poor nations alike have immediate access.”

Finally, I agree with Gita when she recommends that, “policymakers will need to ensure that people are able to meet their needs and that businesses can pick up once the acute phases of the pandemic pass. The large, timely, and targeted, fiscal, monetary, and financial policies already taken by many policymakers—including credit guarantees, liquidity facilities, loan forbearance, expanded unemployment insurance, enhanced benefits, and tax relief—have been lifel

ines to households and businesses. This support should continue throughout the containment phase to minimize persistent scars that could emerge from subdued investment and job losses in this severe downturn.”

I’ve highlighted this last sentence, and in particular the words “persistent scars.” As the Gallup poll informs us, we must be mindful in U.S. national policies to attend to both the financial/economic scars as well as physical and mental health now and in post-pandemic life in 2021.